In the rapidly evolving landscape of digital finance, platforms like Venmo have become household names, simplifying how we manage and transfer money. Behind the scenes, technologies like Plaid play a significant role in enhancing the capabilities and user experience of these platforms. In this article, we’ll explore the partnership between Plaid and Venmo, examining how plaid venmo integration contributes to the seamless financial connectivity that users enjoy.

Plaid Powering Financial Interactions

Contents

Plaid is a fintech company that specializes in providing secure and streamlined connections between various financial institutions, applications, and users. Its technology acts as a bridge, allowing users to securely link their bank accounts to different apps and platforms. Plaid’s API (Application Programming Interface) enables seamless data sharing while prioritizing security and privacy.

Venmo’s Integration with Plaid

Venmo, as a leading peer-to-peer payment platform, benefits from Plaid’s technology to enhance its functionalities and offer users a more comprehensive experience. Here’s how Plaid integrates with Venmo:

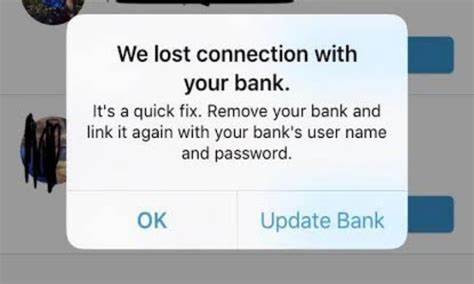

- Bank Account Linking: Plaid enables Venmo users to link their bank accounts seamlessly. When adding a bank account to Venmo, Plaid’s technology facilitates the secure connection between the two accounts.

- Verification and Authentication: Plaid’s technology helps verify and authenticate bank accounts, ensuring that users have the correct account details before initiating transfers.

- Transaction Data: Plaid enables the retrieval of transaction data, making it easier for users to categorize their expenses, track payments, and gain insights into their financial activities.

Benefits of Plaid Integration for Venmo Users

- Convenience: Plaid’s integration streamlines the process of linking bank accounts, reducing the need for manual entry of account information.

- Security: Plaid prioritizes security and encryption, ensuring that sensitive financial data is transferred securely between Venmo and users’ bank accounts.

- Real-Time Updates: Plaid’s technology provides real-time updates on account balances and transaction history, allowing users to stay informed about their financial status.

- Enhanced Insights: With transaction data readily available through Plaid, Venmo users can gain a clearer understanding of their spending patterns and make informed financial decisions.

- Reduced Errors: Plaid’s integration minimizes the risk of errors during the account linking and verification process, contributing to a smoother user experience.

Looking Ahead

The partnership between Plaid and Venmo showcases the power of collaboration in the fintech industry. As technology continues to advance, we can expect further innovations and enhancements that leverage Plaid’s capabilities to provide users with even more seamless and secure financial interactions. Whether it’s sending money to friends, splitting bills, or gaining insights into personal finances, Plaid’s integration with Venmo contributes to a holistic and user-centric approach to digital payments.

In the dynamic world of digital finance, Plaid plays a vital role in enhancing the capabilities of platforms like Venmo. Through secure bank account linking, verification, and transaction data retrieval, Plaid’s technology enriches the Venmo experience for users. As both companies continue to innovate, we can anticipate more collaborative efforts that shape the future of financial connectivity and convenience.